The banking industry is the most prominent victim of various hacker attacks. Most banks hold sensitive customer information, money transactions, and confidential files. These facts put banks in the crosshairs of hackers. Banks need a staffing solution to fill key roles. This will help them meet the demands of their expanding workforce. But the lack of proper security may expose the recruitment process to cyber threats.

That is why it is so important to understand the role of cybersecurity in Banking Staffing Solutions. It not only secures customer confidence but also ensures smooth operations. The article explains Cybersecurity in Banking – Why It Matters for Safety & Trust is important for staffing. It highlights the risks banks face, the dos and don’ts of data protection, and how a positive attitude can boost recruitment and security.

Why Cybersecurity Matter in Banking

Staffing agencies help banks fill tough positions, such as IT and financial experts. During hiring, sensitive info can be shared. This includes employee records, background checks, and bank system access. Such information, if allowed to be stolen, can become a jackpot for cybercriminals.

Cybersecurity in banking staffing solutions protects customer and employee data from cyber threats. This includes threats from both inside and outside the organization. A weak link in recruitment can make banking operations open to breaches. A single cyberattack can cost the bank millions and damage its reputation for years.

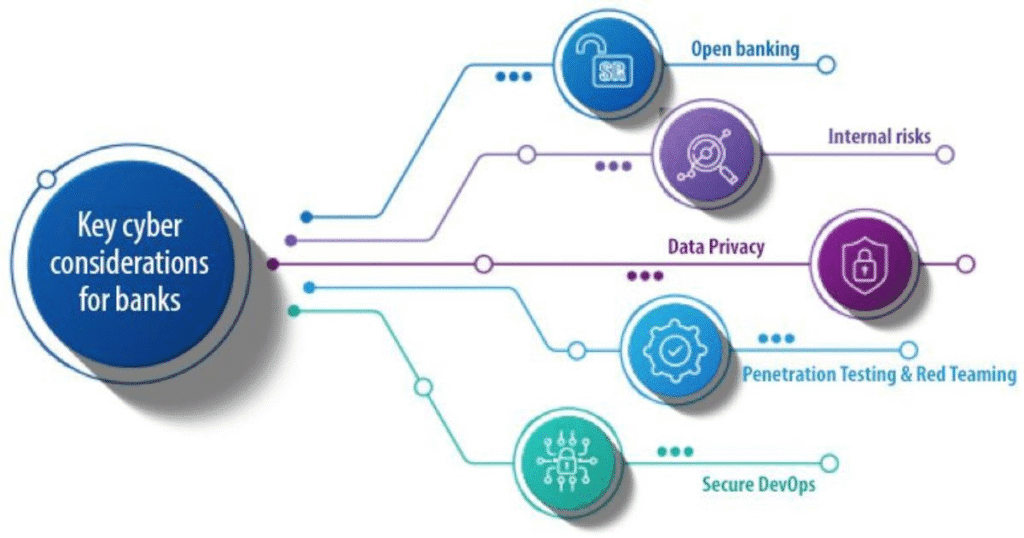

Key Cybersecurity Risks in Banking Staffing

Banks face cybersecurity in Banking issues when they outsource staffing solutions or rely on digital recruitment tools. Here are some of the most typical threats:

1. Data Breaches

Hackers may hack databases that contain resumes, or personal details, or even companies payroll records. Without adequate security, this information can be stolen and then used for illegal activities.

2. Phishing Attacks

Made-up letters may lead workers and job seekers into passing their login details or other financial data to the fraudsters. The staffing department is the major prey of this kind of trickery.

3. Insider Threats

Some employees or contractors may gain and then exploit access to sensitive systems. This risk becomes even more significant when staffing firms are present because in this case, there could be more people handling confidential information.

4. Unsecured Technology

are not properly managed, they are like doors that allow intruders to enter.

Covering such vulnerabilities will add staff comfort and customer trust in banks aside from the overall safety of the staffing circulation.

The Role of Cybersecurity in Protecting Staffing Processes

While installing firewalls, hard-to-detect viruses, or malware software is part of a broader cybersecurity architecture in banking staffing, it serves a minor role. The staffing function in banks entails much more than that:

- Protecting candidate data – Data such as Social Security numbers, addresses, and background reports have to be confidential at all times.

- Securing access points – The moment a new employee is granted system access, cybersecurity must be in place to avoid malicious use of the access.

- Maintaining compliance – Banks are obliged to adhere to strict regulations such as GDPR, PCI DSS, and other data protection laws. A staff compliant help from IT assures that the recruitment part does not fall out the line.

- Building trust – Both customers and employees feel safer knowing the bank takes cybersecurity seriously in every process.

In other words, Cybersecurity in Banking Staffing Solutions is the cornerstone of trust and safety in contemporary banking.

Best Practices for Cybersecurity in Banking Staffing Solutions

To beef up security, banks should take a step ahead of the problem and go beyond just reacting to breaches. The following are some effective measures that could be implemented:

1. Secure Staffing Platforms

To ensure a safe recruitment process, you must use suitable software. This software should be verified and encrypted for managing the workforce. This makes it impossible for hackers to get into the databases.

2. Multi-Factor Authentication (MFA)

Require staff and candidates to provide multiple proofs of identity before they can gain access to a staffing system. MFA will not allow the intruder to use the stolen password alone to gain access without the additional verification factor.

3. Regular Cybersecurity Training

Human resource teams and employees need to be schooled in security concepts and in the detection of phishing, scamming, and other suspicious activities. People’s alertness is among the best shields.

4. Access Control

Restrict the right to use the system exclusively to the necessary people. The newly recruited staff should be granted access rights that are directly relevant to their jobs.

5. Data Encryption

All sensitive data must be encrypted whether the data is stored or transferred via staffing procedures. In this way, the data thief will not be able to read the stolen data.

6. Vendor Risk Management

If third-party staffing agencies are used, banks must ensure these partners follow strict Cybersecurity in Banking policies.

7. Regular Audits

Conduct Cybersecurity in Banking audits to identify and fix weak points in staffing platforms and recruitment systems.

By adopting these practices, banks can reduce risks and make staffing solutions more secure.

How Cybersecurity Builds Trust in Staffing Solutions

Trust is the foundation of banking. Customers trust banks with their money, and employees trust banks with their careers. But without proper cybersecurity, this trust can be broken.

When a bank demonstrates strong Cybersecurity in Banking Staffing Solutions, it shows commitment to both employee safety and customer protection. This can:

- Increase customer confidence.

- Attract top talent who value data security.

- Reduce financial losses from breaches.

- Improve overall brand reputation.

In today’s digital era, trust and Cybersecurity in Banking go hand in hand.

The Future of Cybersecurity in Banking Staffing

As banking becomes more digital, cybersecurity challenges will continue to grow. Artificial intelligence, automation, and cloud technology are changing the way staffing works. While these tools make recruitment easier, they also create new risks.

Future staffing solutions will need even stronger cybersecurity frameworks. This includes:

- AI-powered fraud detection to spot suspicious activities.

- Blockchain technology for secure data sharing.

- Zero-trust security models that verify every user, every time.

Banks that invest early in cybersecurity will not only stay safe but also lead the way in innovation.

Conclusion

Cybersecurity in Banking is no longer a luxury within the banking system; it is a must. Staffing solutions help banks find the right people. They can drive the bank’s success. But these solutions can pose risks if not managed properly. Cybersecurity in Banking Staffing Solutions should be a top priority.

Banks can safeguard their workforce and customers by facing risks head-on. They should adopt best practices and prepare for the future. Securing staff processes isn’t just about compliance. It’s key to building a strong and secure financial system.

As cybersecurity becomes essential in the banking sector, professionals with the right skills are in high demand. Explore the Top 10 Cybersecurity Field Certifications to Boost Your Career to build expertise in this growing field.

FAQs

1. What is the Role of Cybersecurity in Banking Staffing Solutions?

The role of cybersecurity is to keep the data of candidates and employees secure, and the entire recruitment process safe. Cybersecurity shields banks from breaches and the staffing operations receive their security from it.

2. Why is Cybersecurity Important for Staffing in the Banking Sector?

Staffing involves managing sensitive personal details, conducting background checks, and controlling system access. This information can be easily misused by cybercriminals. If they gain access, the organization could face serious cybersecurity issues.

3. How Can Banks Secure Their Staffing Platforms?

The bank can enhance security on their staffing platforms by:

- Installing encrypted systems

- Using multi-factor authentication

- Conducting regular security audits

4. What Are the Biggest Cybersecurity Risks in Staffing Solutions?

The major cybersecurity risks that come hand-in-hand with staffing solutions are phishing attacks, the misuse of the position of an insider, unsecured recruitment software, and data breaches.

5. How Does Cybersecurity Improve Trust in Banking Staffing Solutions?

The fact that banks are serious about implementing cybersecurity measures is what gives banks customers and employees the reassurance they need. The list of winners in this case includes banking customers, bank employees, and bankers themselves because through cybersecurity a bank is given a better chance to increase its loyalty and maintain a sound reputation.